SliQ Invoicing Online supports VAT Reverse Charges for UK VAT registered businesses. From 1 March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services. The charge applies to standard and reduced-rate VAT services. The sections below describe how to ensure VAT Reverse Charge support is enabled in SliQ Invoicing Online.

For more information from HMRC on on the VAT Reverse charge, see VAT Reverse Charge.

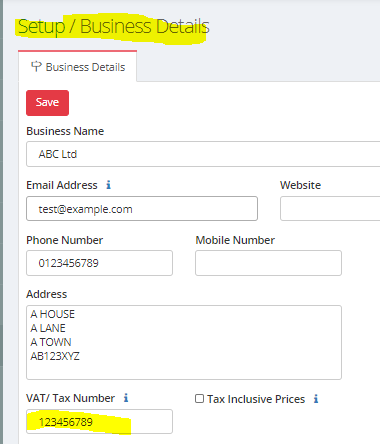

Make Sure You Have Entered Your VAT Number

Go to the Setup page and select the Business Details link to view your basic business information. Make sure you have entered your VAT number.

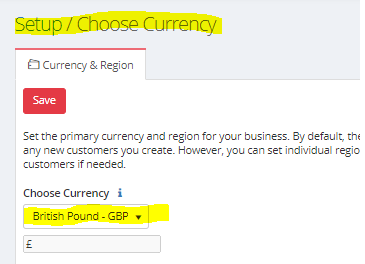

Make Sure You Have GBP as your Currency

Then go to the Setup page and select Currency and make sure you have GBP selected.

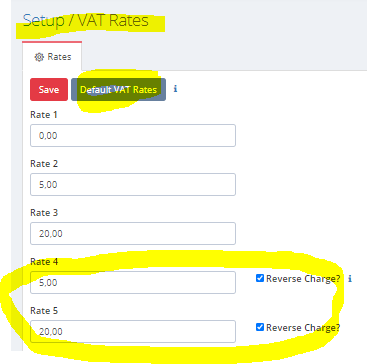

Make Sure you have Reverse Charge Rates Defined

Go to the Setup/ VAT Rates page and check you have the two reverse charge rates defined. If you do not see the reverse charge rates, you can either enter them yourself or click the Default Rates button.

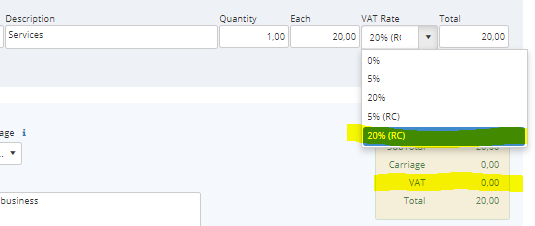

Once the rates are defined you can then select them when adding line items to invoices and no VAT will be added to the invoice for the line item, e.g. in the picture below the 20% reverse charge rate – 20% (RC) – is selected.

Make sure Your Template Includes the VAT Rate and VAT columns

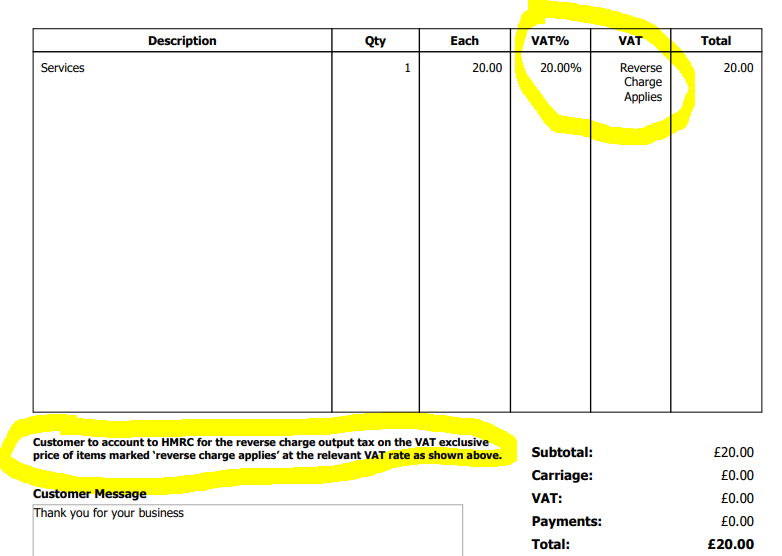

When you print or email an invoice you need to make sure the invoice clearly indicates that a reverse charge is being used and that the customer is responsible for accounting for the VAT to HMRC. SliQ Invoicing Online includes a new invoice template that shows the VAT Rate and VAT columns and includes a message indicating that any VAT Reverse Charges on the invoice need to be accounted for by the customer. You can select this template on the Setup/ Choose Template Styles page. If you are using a custom template you can modify the template to include the highlighted features below from the standard classic1reversecharge template.

The classic1reversecharge template includes both the VAT and VAT Rate columns as well as an extra label that indicates the customer is responsible for accounting for VAT on the reverse charge items.

To make these modifications to your existing custom template you can use the SliQ Invoicing Online Template editor. For help on configuring columns and adding labels to templates in the editor, see the following help links: